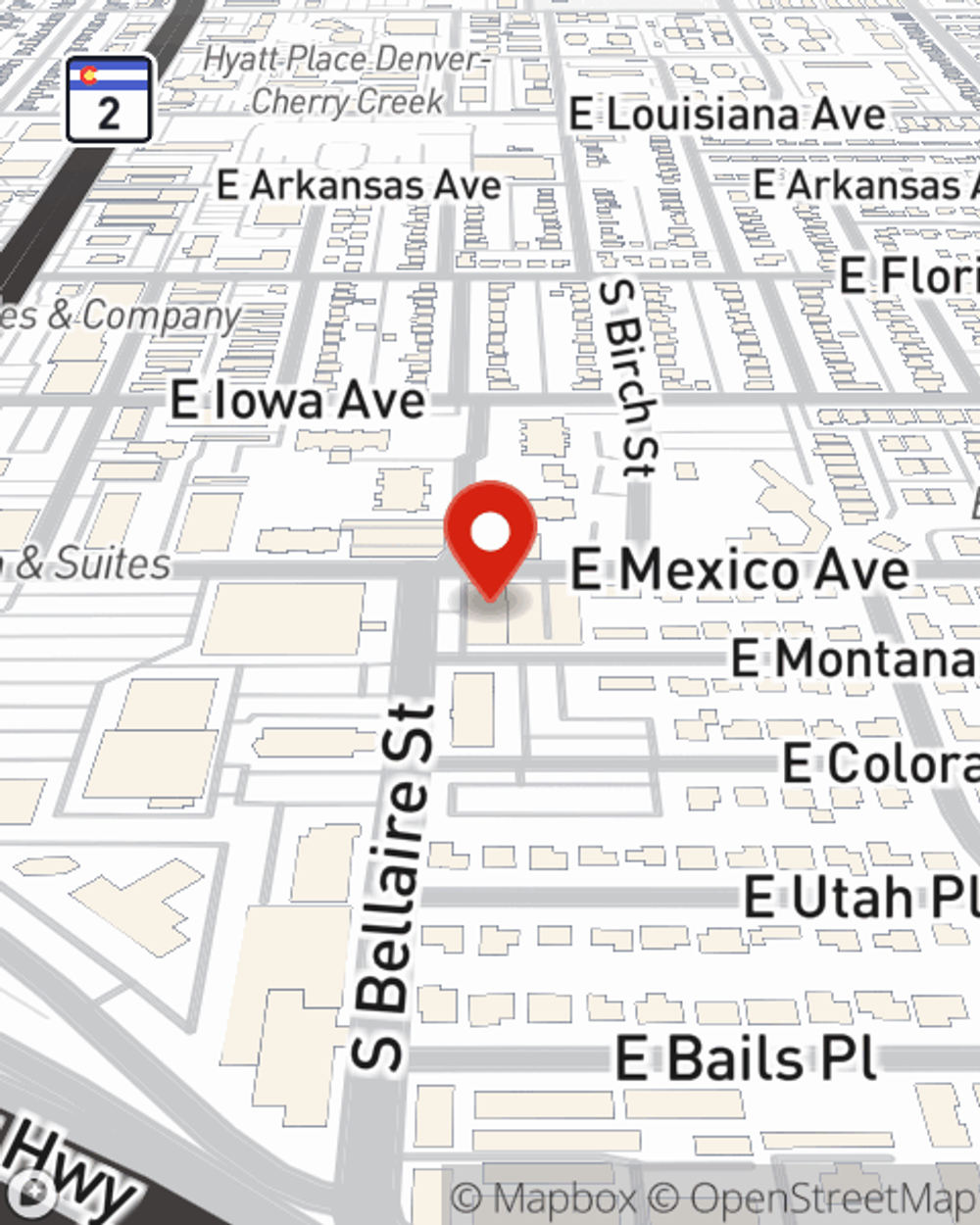

Business Insurance in and around Denver

Researching coverage for your business? Search no further than State Farm agent Nat Owen!

This small business insurance is not risky

- Denver

- Littleton

- Arapahoe

- Greenwood Village

- Wash Park

- Englewood

- Lakewood

- Centennial

- Aurora

- Westminster

- Golden

- Arvada

- Wheat Ridge

- Parker

- Highlands Ranch

- Morrison

- Commerce City

- Cherry Creek

- University

- Cheesman Park

- RiNo

- Park Hill

- Baker

- University Park

Coverage With State Farm Can Help Your Small Business.

Do you own a photography business, a yogurt shop or a pet groomer? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on what matters most.

Researching coverage for your business? Search no further than State Farm agent Nat Owen!

This small business insurance is not risky

Insurance Designed For Small Business

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Nat Owen. With an agent like Nat Owen, your coverage can include great options, such as worker’s compensation, commercial auto and artisan and service contractors.

As a small business owner as well, agent Nat Owen understands that there is a lot on your plate. Get in touch with Nat Owen today to review your options.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Nat Owen

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.